There are two common options when deciding which IRA works best for you: traditional and Roth. Each of these options offers unique benefits and tax advantages, making it important to understand how they differ before deciding which one suits your financial goals. While both types allow individuals to save for retirement with tax benefits, they have different rules when it comes to contributions, tax treatment, and withdrawals. Whether you are looking for an immediate tax break or planning for tax-free withdrawals in the future, understanding the differences between a traditional and Roth IRA is crucial to making an informed decision that aligns with your retirement strategy.

What is an IRA?

An IRA (Individual Retirement Account) is a tax-advantaged savings tool established by the IRS to make it easier for individuals to save for retirement.

There are two primary types of IRAs: the traditional IRA and the Roth IRA.

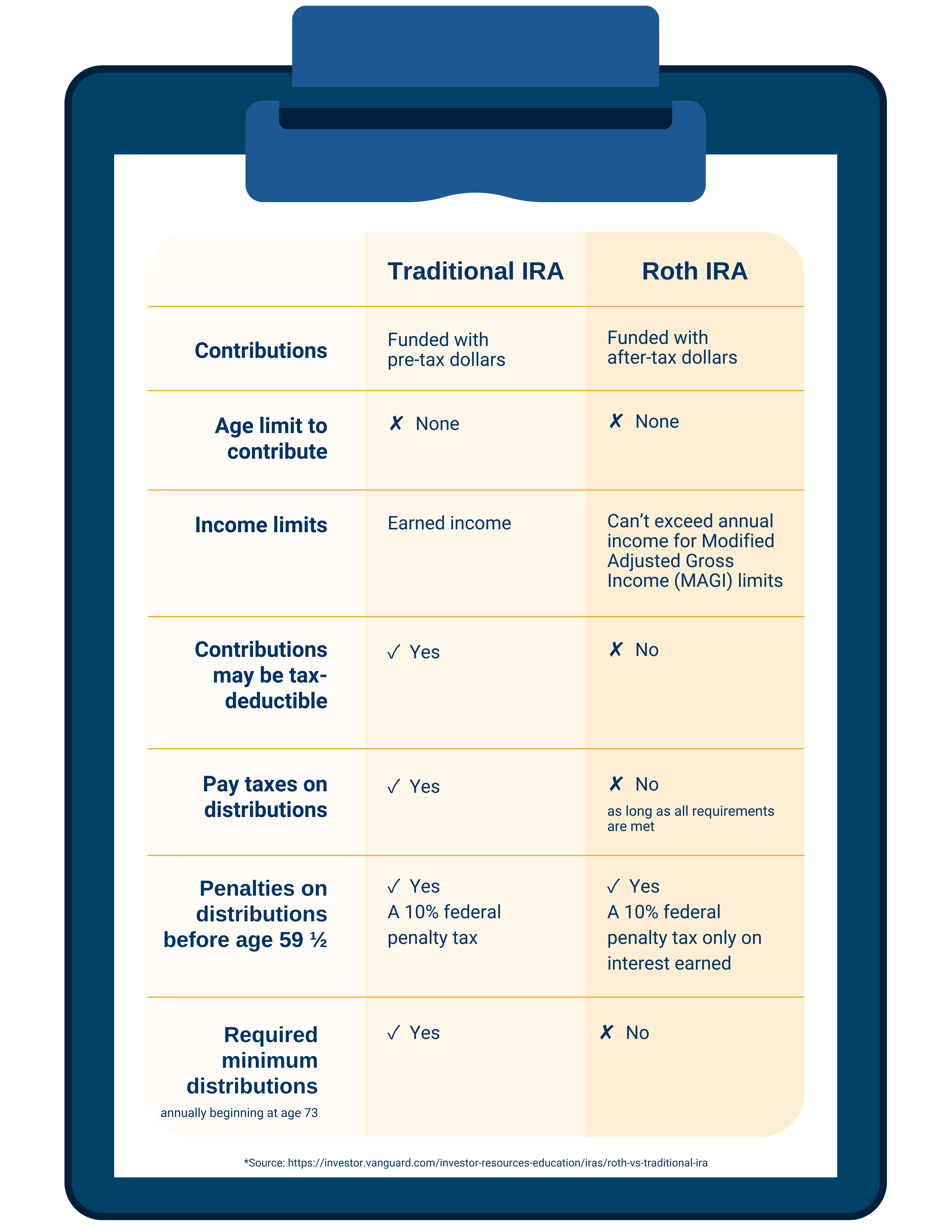

A Roth IRA allows for after-tax contributions, making it ideal for those who expect to be in a higher tax bracket when they begin withdrawing funds. With a Roth IRA, both your earnings and withdrawals grow tax-free. This means you could potentially avoid paying taxes when you withdraw your money. Additionally, after holding the account for at least five years, you can take distributions anytime after age 59½ without penalty.

On the other hand, a traditional IRA typically permits pre-tax contributions and is more suitable for individuals who anticipate being in the same or a lower tax bracket when they start withdrawing funds. A traditional IRA offers the advantage of potential double tax benefits: your contributions may be deductible from your taxable income, and the interest grows tax-deferred. You won’t pay taxes on your investment gains until you make a withdrawal, which could be at a time when you’re in a lower tax bracket.

It’s essential to understand your financial trajectory to make the right choice for your future. To help you plan, try using our retirement planning calculator.

If you’re considering opening an IRA or need guidance on how to start funding one, our experienced team at Cleveland State Bank is here to assist you.

Schedule an appointment with us to begin your journey toward a successful retirement.

Disclaimer: This article is provided for informational purposes only and is not intended to be used as legal, tax, or financial advice. Laws and regulations concerning taxes are complex and subject to change. As such, we strongly recommend consulting with a professional tax advisor, accountant, or attorney to obtain advice tailored to your individual situation. Reliance upon any material provided herein is at your own risk.