The Do's and Don'ts of Refinancing

What is refinancing?

Refinancing, sometimes called refi, replaces your current home loan with another one. Often you replace your older loan with one with a better interest rate to save money during the loan duration.1 Refinancing your mortgage can also allow you to get a new loan with different terms more suited for your situation, like going from an adjustable-rate to a fixed-rate mortgage loan.2

Why refinance?

There are many reasons why you should, or in some cases shouldn’t, refinance your home. These dos and don’ts are tips to help you make the right decision for your situation.

DO refinance to take advantage of low-interest rates

Let’s say you’ve worked hard to raise your credit score and your financial profile has improved. Refinancing your mortgage loan may now be an option that allows you to take advantage of lower interest rates compared to when you initially applied for a mortgage.3 Your monthly mortgage payments and insurance can decrease, ultimately saving you money over the lifetime of the loan.4

DON’T refinance if you plan to move

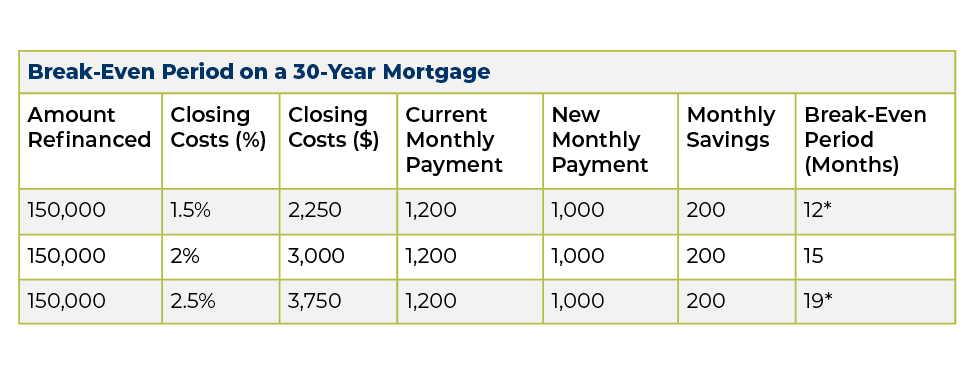

If you’re thinking of refinancing, tread carefully if you plan to move significantly earlier than expected.5 When you consider refinancing your home, keep in mind the break-even period.

The break-even period is the amount of time it would take to recover the closing costs of the new loan. After this period, you start to save money on your new mortgage.6

To calculate your break-even point, you will need to know the closing cost and the interest rate on the new loan. Once you have that information, you divide your closing cost by the monthly savings. 7

Moving before the break-even period ends may not be a good choice if you’re planning on refinancing your mortgage loan.8

DO refinance if you’re looking for a shorter-term loan

If you refinance your loan, switching from a 30-year to a 10, 15, or even 20-year mortgage may mean you pay significantly less interest over time.9 Lessening your term could also mean you could own your home entirely and be free from mortgage debt.10 However, your monthly payments may increase, so considering if you can afford a higher mortgage payment is crucial.11

DON’T refinance if your financial situation is toxic

Have you checked your credit report lately? If you’re looking to refinance your mortgage loan, audit your credit accounts. Look into your current debt-to-income ratio as this heavily affects your credit scores. There are several types of credit scoring models but the most popular are your FICO score and Vantagescore 3.0. Regardless of the credit model, your credit scores heavily influence the interest rate you obtain from refinancing.12

As stated, if you are locked in a shorter term, your interest rate may decrease. Still, your mortgage payment per month may increase during the life of the loan.

It may be tempting to take advantage of the historically low-interest rates, but if your financial situation is not as ready as you think it is, you may be doing yourself more harm than good.

Can you afford the closing cost and the potentially higher mortgage payments per month within your budget? If not, then refinancing at this time may not be the best choice. Refinancing is not free, so if you’re not able to pay the closing costs, it is an option to add it to your new loan. However, you have to pay interest on the closing costs in the loan duration.13

DO refinance to drop PMI and other mortgage insurance

Private mortgage insurance, or PMI, is a type of mortgage insurance. This mortgage insurance is required for homeowners who could not provide at least 20% of a down payment towards the initial home value. PMI provides mortgage lenders a financial buffer if you default on your mortgage.14 It is usually determined by factors like your debt-to-income ratio and credit score. Your PMI can be canceled before it is scheduled to drop off from your home loan. Knowing when you are eligible to stop your PMI payments can help you save even more.15

Borrowers with a Federal Housing Administration (FHA) loan and a mortgage balance below 80% may qualify for a conventional loan and drop PMI.16, 17

After reading our dos and don’ts, does refinancing make sense for you? Let us show you how we care about reaching your financial goals by contacting our mortgage specialists today!